Student recipients of $30,000 in Scholarships

Lori Impey • November 16, 2024

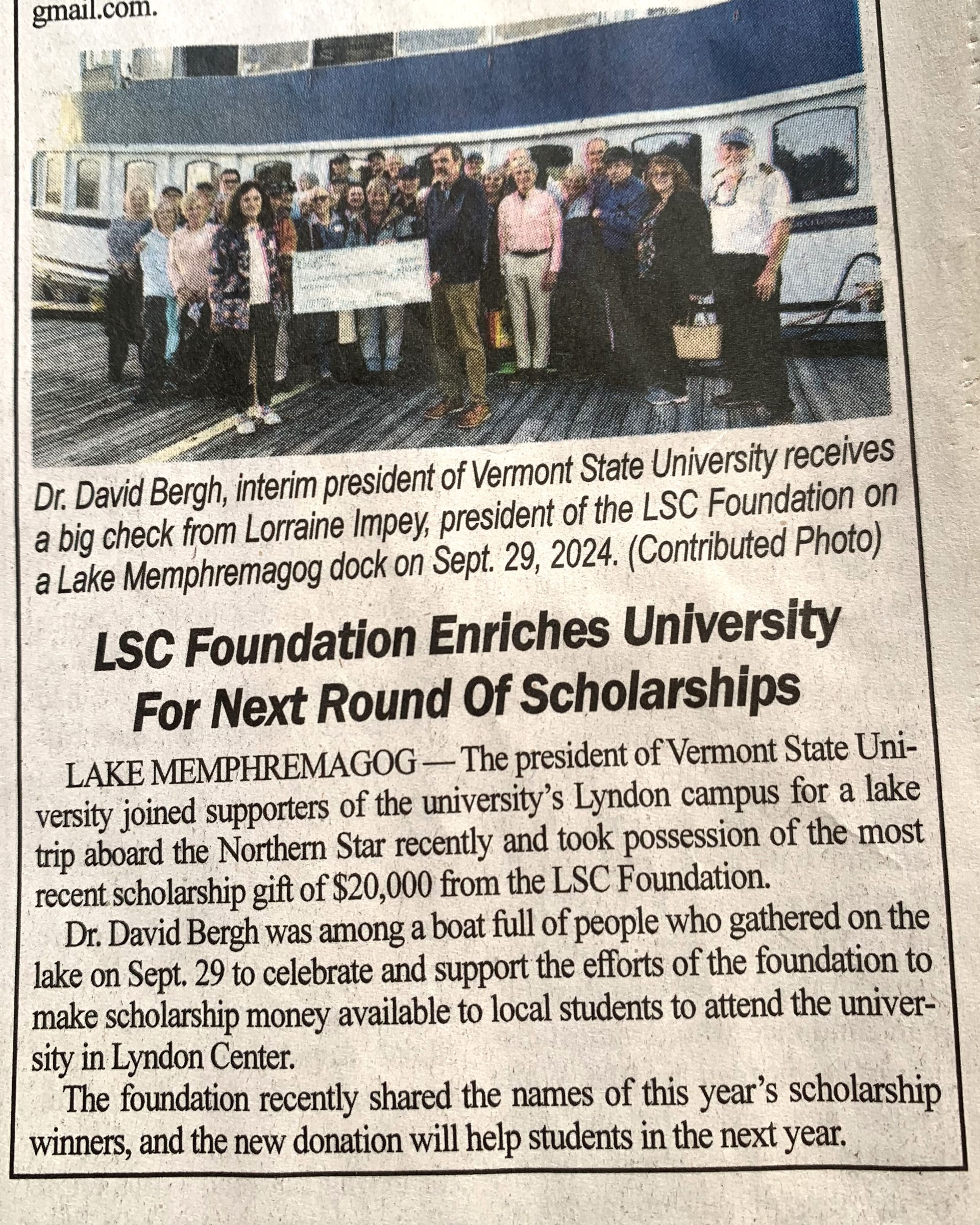

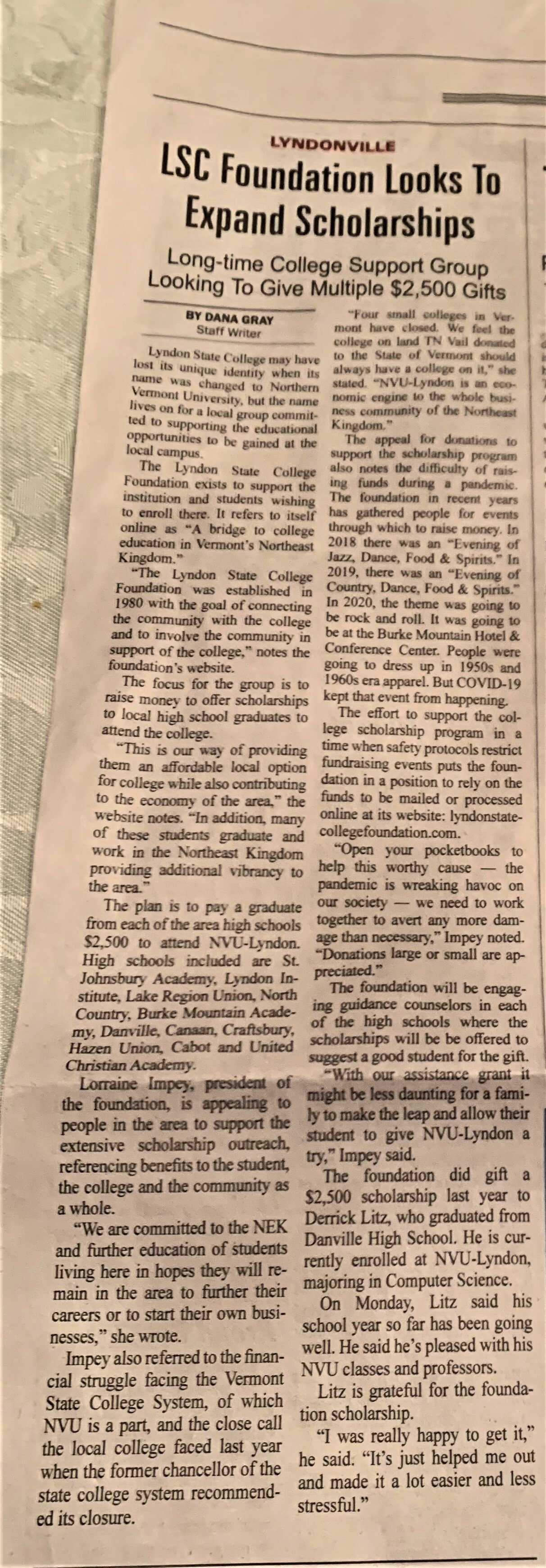

Caledonian-Record article September 30, 2024

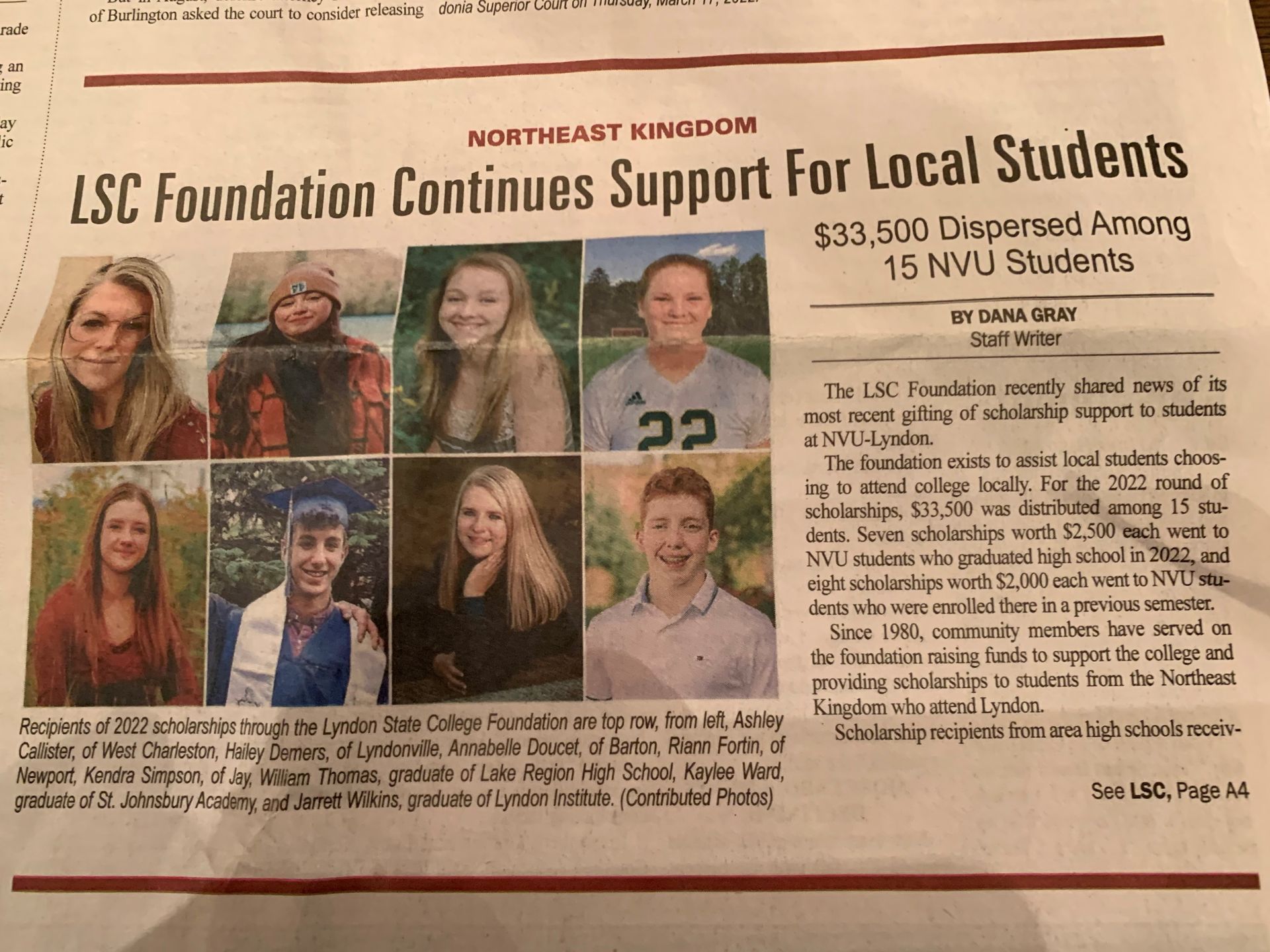

Seventeen recipients divided $30,000 in scholarships for the Fall semester at VTSU-Lyndon. Four graduating seniors from NEK high schools received $2500 each. The LSC Foundation thanks all our supporters who enlighten the lives of so many students. The students are so thankful for the financial help that makes a crucial difference in their ability to attend VTSU-Lyndon. Read the whole article as posted in the Caledonian-Record on September 30th.

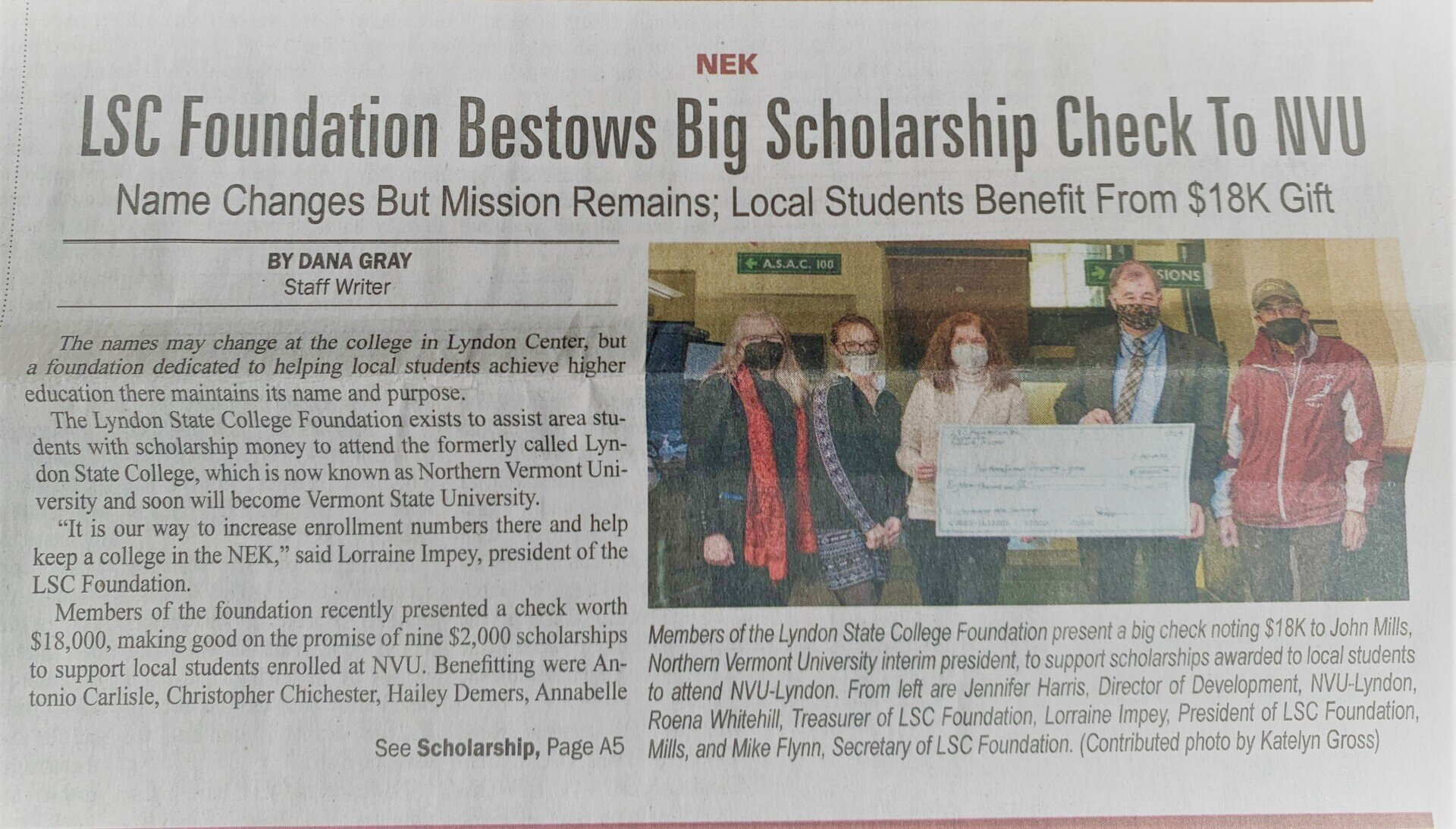

We are pleased Derrick Litz made the decision to attend NVU-Lyndon and that our $2500 scholarship helped make his decision easier. This year we are looking to gift a scholarship to a senior from each of the High Schools in the Northeast Kingdom. This is made possible by the help of our supporters. Thank you to all of you who help us keep local students furthering their careers at NVU-Lyndon.